Technically, my debt is "good debt." Mostly student loans. And my car payments. That's it. But I still hate seeing the number every month and I'm ready to invest in things- like a house. I don't want to add a house payment into the mix right now, so I'm trying to pay off all my student loans before I consider home ownership.

Even though this is a resolution, I know that it won't happen this year. I have more debt than I even make in a year, so this is definitely a long(er) term goal, but I'm ready to get

I am not following Dave's advice 100% though, because I'm keeping my credit card. Sorry, Dave. I think I am pretty good about spending and I mostly pay it off every month so it stays!

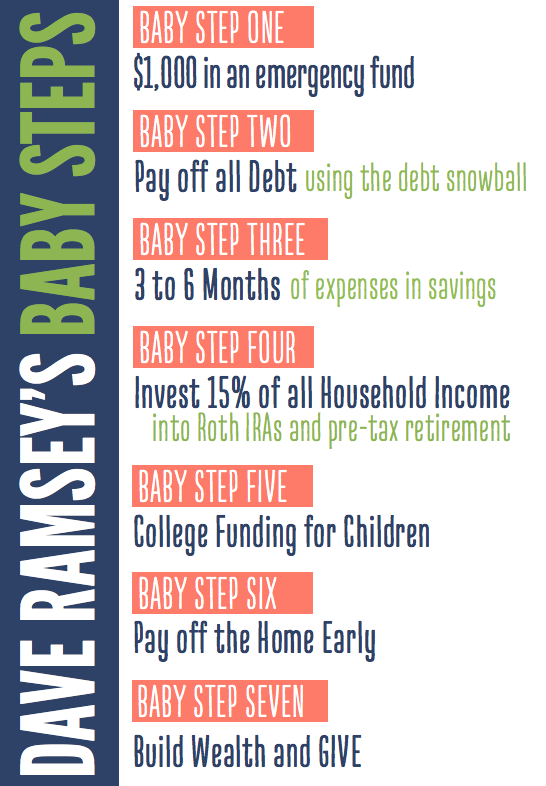

I have already knocked out Step 1. Now I am working on Step 2. Slowly and steadily chipping away at the mountain of debt. But then when it's all paid off, I will celebrate! And then buy a house and start the debt thing all over again. Ha!

To break down my current resolutions, #1 was to put a certain amount of money into savings. According to Step 3, I already have about a month worth of expenses in savings. My goal this year is to put another month's worth in. I know that Dave says to do the steps in order, but I've already decided I'm doing my own modified version so why not break the rules on this part too?

Financial resolution #2 is to pay off a certain amount of my loans this year. It is not a ridiculous amount. It is definitely doable, but it also isn't easy. It will definitely requiring saving and sacrifice. I think that is the sweet spot for resolutions- attainable, but a stretch.

In order to make numbers 1 and 2 happen, #3 has to be there too. A budget. I have tried different methods of budgeting throughout the years and this year I'm going to try something a little different. The credit card stays for gas and groceries, but everything else will be on a cash budget. I'll take out a certain amount of cash each week and it will be used for anything fun I want to do or anything I need to buy that week. Once it's gone, it's gone.

We'll see how it goes, but the ultimate goal of getting out of debt and then buying a house is a motivating one!

What are some of your financial goals? Are you saving up for one big purchase? How do you budget?

No comments:

Post a Comment